The #1 Automation & Text Messaging Platform For Small Businesses

The first ever platform built to manage a Business's Follow up, two-way texting, pipeline, scheduling, and so much more.

Built for Agencies, By an Agency.

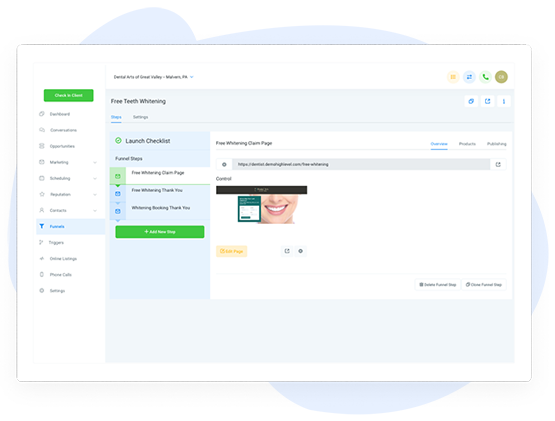

Your End-To-End Funnel Marketing Solution

Build forms and funnel pages to capture leads, user automated sms, email, phone calls, voicemails, and Facebook Messages to nurture leads through custom pipelines, converse with leads & clients via text, phone, and Facebook Messenger (all in one stream!), and more!

Build Forms & Landing Pages To Capture Leads

Use our drag-and-drop form and funnel builders to create landing pages that convert traffic to leads that get stored in HighLevel.

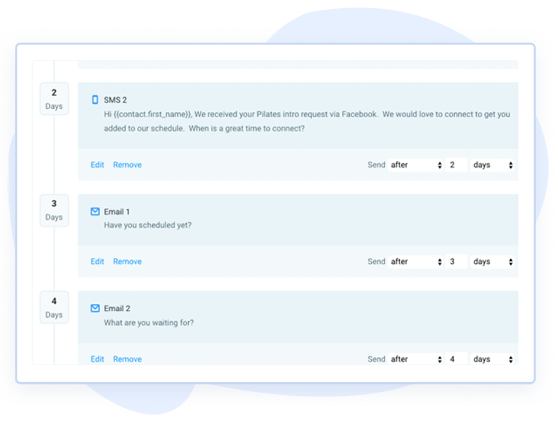

Convert Leads With Robust Automations

Build custom nurture campaigns that send text messages, emails, voicemails, and even Facebook messages to convert leads automatically.

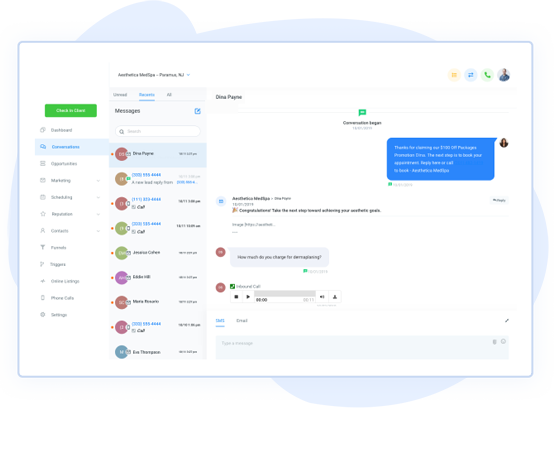

Converse With Leads & Customers In One Place

Keep track of conversations whether they happen via text message, email, phone calls, or Facebook messages. Two-way text included!

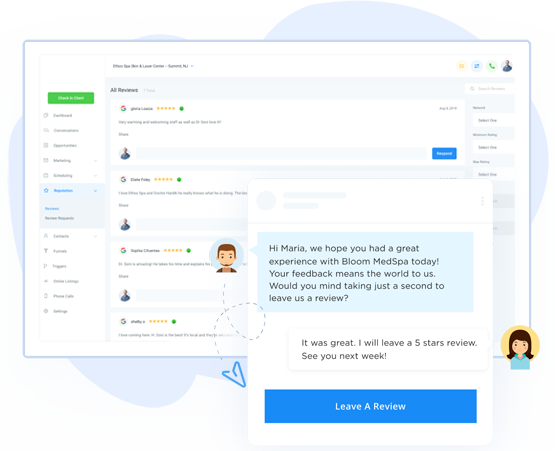

Build & Manage Your Online Reputation

Send review requests via SMS and email with the push of a button. Monitor and reply to new reviews right within the dashboard.

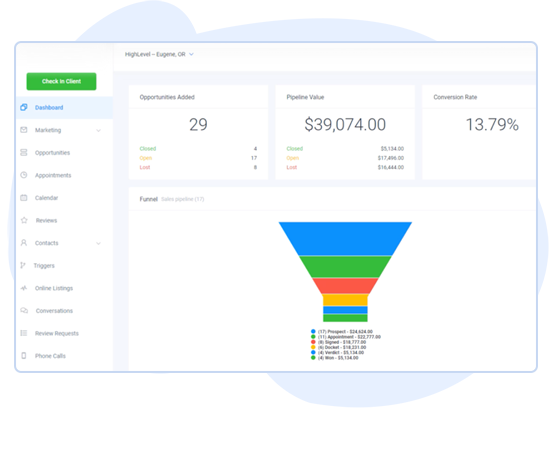

Complete Advanced Analytics Dashboard

The ability to track the ROI and Leads in a pipeline has become even easier through our advanced Dashboard. Track stats such as appointment rates, campaign effectiveness, and even response rates!

Blogs

Is There a Formula for the Perfect Outsourced Bookkeeping Services?

Every entrepreneur handles countless tasks, and messy financial records only add stress. Additionally, outdated systems hide trends and delay critical decisions. Most owners lack the time to reconcile accounts accurately. Mistakes then disrupt budgets and cash flow. Fortunately, an outsourced bookkeeping service can restore order quickly. At Operations X, certified pros apply modern tools to track expenses, reconcile transactions, and generate reports. Moreover, clients access real-time data without hiring extra staff.

Consequently, businesses secure clear budgets and focus on growth. In this post, we outline clear criteria and tips to select a trustworthy bookkeeping partner. Finally, we share expert best practices.

What Makes Outsourcing a Smart Move?

Outsourcing key operations frees internal teams to tackle core goals. For example, IT outsources services to handle IT maintenance without hiring full-time staff. Moreover, outsourcing services extend beyond technology to cover finance, marketing, and more. Businesses then tap specialized skills at predictable costs.

For instance, outsourced CFO services deliver budgeting and forecasting expertise on demand. In addition, organizations can outsource SEO services to boost online visibility while focusing on strategic planning. Furthermore, professional bookkeeping works in harmony with these functions to maintain clear financial records.

Therefore, combining multiple outsourced partners creates a seamless support network that drives efficiency and cost savings. As a result, firms avoid recruitment delays and reduce overhead. Next, teams receive expert guidance without long‑term contracts. Additionally, project scopes remain flexible to adapt to changing demands quickly. Moreover, providers guarantee consistent service quality.

Want to reduce costs and boost accuracy? Contact Operations X now and transform your accounting workflow with expert bookkeeping today.

How an Outsourced CFO Fits In

An outsourced CFO brings high-level strategy to financial management. Moreover, CFOs focus on forecasting, budgeting, and risk assessment. As a result, businesses gain predictive insights to guide growth. Without full‑time hires, firms cut overhead and stay agile. In addition, outsourced CFOs evaluate performance metrics and identify cost‑saving opportunities.

They then advise on capital allocation and cash flow optimization. Furthermore, these professionals integrate closely with bookkeeping teams to ensure data accuracy. Consequently, companies make informed decisions backed by reliable numbers. Therefore, combining an outsourced CFO with bookkeeping services builds a comprehensive financial framework. CFOs set targets and monitor progress.

They design financial models to test scenarios. Moreover, these experts support fundraising efforts with clear projections. They streamline stakeholder reporting, lenders included. Ultimately, this service reduces financial risk and fosters sustainable growth. Furthermore, they improve financial transparency.

Choosing the Right Bookkeeping Partner

Choosing the right bookkeeping partner ensures accurate records and peace of mind. Evaluate service scope, security measures, communication style when considering options. Focus on providers with proven credentials and client-centric support to meet diverse needs.

Ask These Key Questions First

For example, ask these key questions before you commit to a bookkeeping partner. First, what pricing model applies, and which fees remain fixed or variable? Next, how often do you receive financial reports, and what formats suit your review process? Also, which software platforms support data integration? Finally, what security protocols protect sensitive records now?

Red Flags You Shouldn’t Ignore

Watch for these red flags to avoid mistakes. First, slow or unclear responses signal poor communication. Next, missing certifications or positive client reviews suggest inexperience. Also, vendors with opaque service scopes may hide extra fees. Furthermore, outdated software or manual processes risk errors. Lastly, if trial periods or exit policies feel restrictive, proceed with caution.

Why Operations X Checks All the Boxes

Choose Operations X for proof of expertise and focus. For instance, our team holds accounting certifications and uses secure cloud platforms. Moreover, we offer clear service agreements with no hidden fees. We update clients weekly with reports. Also, our support team responds within hours to queries. Therefore, you gain both accuracy and peace of mind.

Benefits of Outsourced Bookkeeping

An outsourced bookkeeping service boosts accuracy, compliance, and productivity. It cuts payroll costs and training overhead. Companies gain expert support without full‑time hires. Additionally, you receive timely reports to inform decisions and secure financial stability

Take control of your finances. Schedule a free consultation with Operations X today to streamline bookkeeping and focus on your business priorities.

Save Money Without Sacrifices

Save money without sacrificing quality by outsourcing bookkeeping. For example, you avoid payroll taxes, benefits, and recruitment fees. Moreover, you eliminate training costs and ongoing software maintenance expenses. With fully predictable monthly rates, budgeting becomes simpler. In addition, you can scale support up or down as needed. Therefore, your firm remains agile and financially efficient.

Real-Time Reports, Less Stress

Access real-time reports that highlight cash flow, expenses, and revenue trends. With up-to-date ultra-efficient dashboards, you monitor financial health at a glance. Moreover, monthly reconciliations catch errors before they escalate. As a result, stress drops dramatically and decision-making speeds up significantly. Furthermore, accurate data on demand helps you plan confidently and avoid surprises.

Keeps Your Business Audit-Ready

Maintain audit-ready records year-round with professional bookkeeping. For example, every transaction gets documented with clear source links. Moreover, compliant systems track changes and provide comprehensive audit trails. As a result, you meet regulatory requirements without last-minute scrambling. Additionally, organized records simplify tax filings and lender reviews. Therefore, audit processes become smoother and less stressful overall.

Will SEO or CFO Tasks Get in the Way?

Clients worry that multiple outsourced services might conflict. Evaluate how SEO needs align with financial reporting and CFO duties. Understanding each provider’s role and integration strategy helps avoid overlap and ensures seamless collaboration across functions.

Define Your Financial Ecosystem

Define a clear financial ecosystem by outlining each service’s role in your operations. Start by mapping bookkeeping tasks alongside CFO strategy and SEO analytics. Moreover, assign dedicated stakeholders to oversee interactions and data flow. This structure prevents data silos and miscommunication. Also, regular coordination meetings keep all providers aligned effectively with your goals and timelines.

Set Clear Boundaries Early

Set clear boundaries early by defining deliverables, deadlines, and communication channels. For example, specify the frequency of financial updates and SEO status reports. Moreover, outline which tasks fall under bookkeeping versus the CFO or marketing scopes. This clarity avoids overlap and frustration. Additionally, establish escalation paths for issues. Consequently, providers work efficiently within strictly defined parameters.

One Dashboard, One Source of Truth

Use a single dashboard to unify data from bookkeeping, CFO analysis, and marketing metrics. This approach ensures all stakeholders see consistent figures in real time. Moreover, choose platforms with API integrations for seamless data flow. In addition, set up automated alerts for anomalies. Therefore, you maintain a single source of truth and eliminate confusion easily.

Scaling Finance Through Outsourcing

As your company grows, bookkeeping demands multiply and consume valuable time. Outsourcing offers flexible capacity to handle spikes in transaction volumes. Moreover, partners can onboard additional staff quickly without recruitment delays. In addition, you avoid unexpected staffing costs and extend support only when needed.

Furthermore, seasonal peaks in sales no longer overwhelm internal teams. Instead, experienced bookkeeping providers assign extra specialists to maintain accuracy. Consequently, your finance function adapts seamlessly to evolving business demands. Also, you benefit from scalable systems that adjust reporting frequency and depth as you expand.

Next, outsourced teams collaborate with your leadership to align financial processes with growth milestones. Therefore, outsourcing bookkeeping ensures cost-effective and reliable finance scaling. For instance, you can integrate new project codes when launching products. Additionally, partners complete training, quality checks to ensure reliable service delivery.

Wrapping Up

Outsourced bookkeeping relieves administrative burdens and delivers accurate, timely financial insights and operational efficiency. By partnering with a qualified provider like Operations X, you gain cost-effective support and strategic reporting. Start enhancing your financial health immediately. Explore our services today to build confidence, compliance, and clarity in every transaction securely.

Contact Operations X for a free consultation and discover how outsourcing bookkeeping can fully save you time, reduce costs, and strengthen your financial foundation today.

FAQs

Q1: What are outsourced bookkeeping services?

Outsourced bookkeeping services involve hiring external professionals or firms to manage financial recordkeeping. These partners handle tasks like data entry, account reconciliations, and accurate report generation using secure, cloud-based systems.

Q2: How do I choose the best bookkeeping partner?

To choose a reliable provider, start by evaluating credentials and industry experience. Ask about software platforms, security protocols, and communication channels. Review client testimonials for proof of performance.

Q3: What are the cost benefits of outsourcing bookkeeping?

Outsourcing bookkeeping reduces expenses by eliminating salaries, benefits, and training costs for in‑house staff. It also cuts software licensing fees and maintenance expenses. With fixed monthly service rates, budgeting becomes more predictable.

Q4: How secure is outsourced bookkeeping?

Reputable bookkeeping services implement strict security measures to protect sensitive data. They use encrypted connections, multi‑factor authentication, and cloud storage. In addition, they enforce access controls and regular backups to prevent data loss.

Q5: When should I consider outsourcing bookkeeping?

Consider outsourcing when your in‑house team struggles to close monthly books or errors recur unexpectedly. High transaction volumes, rapid growth, or upcoming audits often overwhelm small departments.

Christina Nelson

"As a business owner, it is always important to know the numbers and statistics in your company. To know your best clients, programs, what is working or not working. Many of us spend years and thousands of dollars on software that we think will help, and spend too much money, time and effort to implement. And if we can’t understand it all, we have to invest/pay another person to understand and implement it all.

As a subscriber to multiple software platforms to keep our businesses at the forefront of the industry, I can truly share this Business Force One software developed by High Level, makes my job as the CEO a simpler one. Meaning I can see new clients coming in the door from multiple resources, our company follow up, conversions, current client’s information, sales, and special offers in one place."

"As a business owner, it is always important to know the numbers and statistics in your company. To know your best clients, programs, what is working or not working. Many of us spend years and thousands of dollars on software that we think will help, and spend too much money, time and effort to implement. And if we can’t understand it all, we have to invest/pay another person to understand and implement it all.

As a subscriber to multiple software platforms to keep our businesses at the forefront of the industry, I can truly share this software developed by High Level, makes my job as the CEO a simpler one. Meaning I can see new clients coming in the door from multiple resources, our company follow up, conversions, current client’s information, sales, and special offers in one place."

Christina Nelson