The #1 Automation & Text Messaging Platform For Small Businesses

The first ever platform built to manage a Business's Follow up, two-way texting, pipeline, scheduling, and so much more.

Built for Agencies, By an Agency.

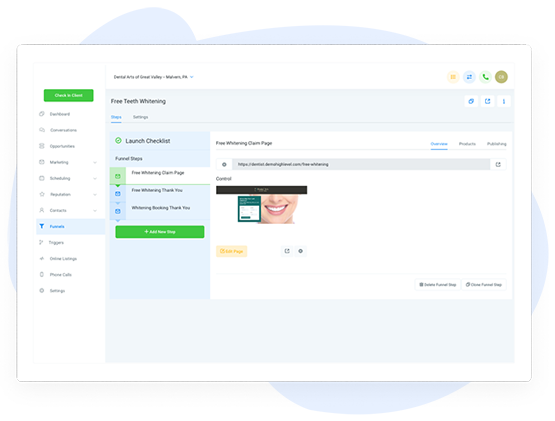

Your End-To-End Funnel Marketing Solution

Build forms and funnel pages to capture leads, user automated sms, email, phone calls, voicemails, and Facebook Messages to nurture leads through custom pipelines, converse with leads & clients via text, phone, and Facebook Messenger (all in one stream!), and more!

Build Forms & Landing Pages To Capture Leads

Use our drag-and-drop form and funnel builders to create landing pages that convert traffic to leads that get stored in HighLevel.

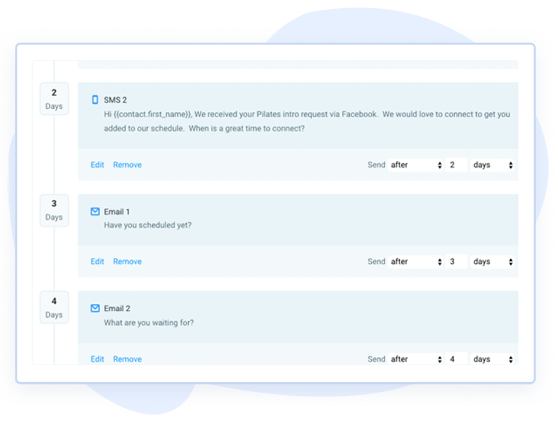

Convert Leads With Robust Automations

Build custom nurture campaigns that send text messages, emails, voicemails, and even Facebook messages to convert leads automatically.

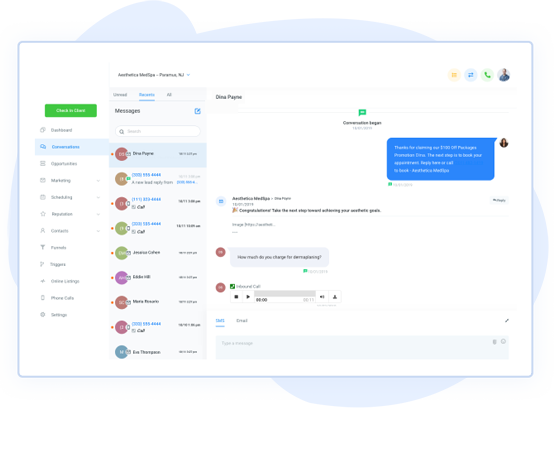

Converse With Leads & Customers In One Place

Keep track of conversations whether they happen via text message, email, phone calls, or Facebook messages. Two-way text included!

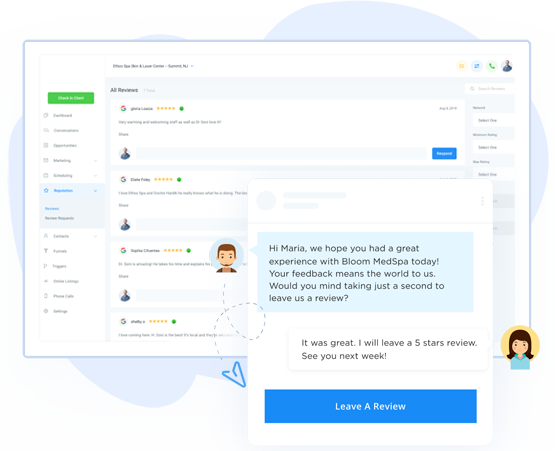

Build & Manage Your Online Reputation

Send review requests via SMS and email with the push of a button. Monitor and reply to new reviews right within the dashboard.

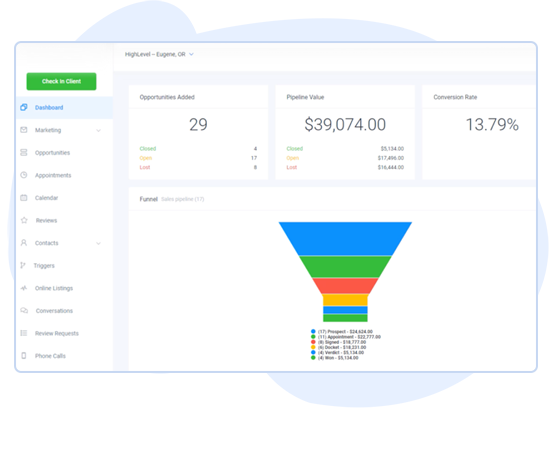

Complete Advanced Analytics Dashboard

The ability to track the ROI and Leads in a pipeline has become even easier through our advanced Dashboard. Track stats such as appointment rates, campaign effectiveness, and even response rates!

Blogs

What's the Secret Behind Payroll Outsourcing Services?

Managing payroll in-house drains time, attention, and often, money. Small businesses spend over 80 hours per year on payroll, leading to avoidable mistakes and compliance risks. That's why many smart businesses are turning to payroll outsourcing services to gain clarity and control.

In this blog, we’ll explore why outsourcing payroll isn't just a trend—it’s a growth move. You’ll walk away knowing exactly how to shift the burden off your team without losing grip on your operations. Ready to rethink your payroll strategy? Let’s get right into it.

Why Businesses Outsource Payroll

Businesses choose payroll outsourcing services for more than just convenience. It’s about precision, compliance, and freeing up internal bandwidth. HR and finance teams often juggle tasks that fall outside their scope, and payroll is one of them.

With third-party experts, you eliminate errors, stay tax-compliant, and streamline your entire payout process. Many companies report fewer late payments, better accuracy, and less stress overall.

➤ Better use of internal time

In-house teams can focus on core operations instead of monthly calculations.

➤ Reduced compliance risks

Professionals handle state and federal updates so you stay aligned.

➤ Improved employee satisfaction

Timely, accurate paychecks keep morale high and trust intact.

What to Expect From a Provider

Not all payroll providers are equal. The best payroll outsourcing services go beyond paychecks. They offer detailed reports, handle tax filing, and adapt to your company’s growth. Expect seamless integrations with accounting tools, real-time updates, and dedicated support. Transparency in pricing and processes is key. They don’t just run your payroll—they safeguard your workforce’s financial well-being.

➤ Integration with your software

Make sure your payroll provider works with your existing tools.

➤ Tax documentation and filing

Your provider should manage taxes without extra fees or delays.

➤ Customer support that’s human

You need responsive help, not long wait times or chatbots.

Simplify, save time, and stay accurate—switch to a smarter payroll process today.

Common Myths About Outsourcing

Some believe outsourcing means losing control. Others think it’s only for large businesses. The truth is, payroll outsourcing services scale for any size. You don’t lose control—you gain it through better oversight, expert handling, and reduced risk. Small businesses benefit the most, especially those without full finance teams. The idea that outsourcing is expensive is outdated—errors and non-compliance cost more.

➤ Myth 1: You’ll lose visibility

Most platforms offer real-time dashboards and reporting access.

➤ Myth 2: Only for big businesses

Even solopreneurs can outsource and see major gains.

➤ Myth 3: It’s too expensive

Compare the costs of errors, penalties, and software outsourcing wins.

Cost Savings That Add Up

Companies often overlook the hidden costs of in-house payroll. We're talking software fees, employee time, training, and risk of error. Payroll outsourcing services eliminate many of these expenses.

No need to train in-house staff on tax changes

Reduce costly penalties from compliance mistakes

Avoid tech costs from outdated payroll software

That’s not just savings—it’s scalability. You're freeing capital for actual growth instead of backend processes. For startups and SMBs, this difference is game-changing.

Signs You Need to Outsource

How do you know it’s time? If your team dreads payday or you’re still tracking time on spreadsheets, it’s already overdue.

You're missing tax deadlines or getting notices

Employees are complaining about late or incorrect pay

You spend more than five hours a week on payroll

You lack secure access to payroll records remotely

Let Operations X lift the payroll burden—focus on building your business instead.

Choosing the Right Partner

Don’t just go with the first option you see online. The right provider understands your industry, integrates easily, and offers transparent pricing.

Check their experience and client success stories

Ensure they’re SOC 2 compliant for data security

Look for flexible contracts—not lock-ins or penalties

Prioritize those who also offer hr outsourcing services, outsourced bookkeeping services, and outsourced accounting services

Choosing well saves you from starting over again in six months.

Conclusion

Payroll shouldn’t be a guessing game or time drain. With payroll outsourcing services, you stay accurate, compliant, and focused on real growth. It's not just delegation—it’s smart delegation. Whether you run a lean startup or a growing team, now is the time to make the shift.

Explore Operations X for full-service solutions—even outsourcing customer service made easy!

FAQs

1. Is payroll outsourcing only for large companies?

No, even small businesses benefit. It’s scalable and cost-effective at any size.

2. How secure is my payroll data with a provider?

Top providers use encrypted systems and follow strict compliance standards.

3. Will I lose control of my payroll?

Not at all. You'll often gain more oversight with real-time dashboards and reports.

4. Can I switch payroll providers mid-year?

Yes, most transitions can be made anytime, with careful record management.

5. Do payroll providers handle taxes too?

Yes, reputable providers manage filings, deductions, and reports.

Christina Nelson

"As a business owner, it is always important to know the numbers and statistics in your company. To know your best clients, programs, what is working or not working. Many of us spend years and thousands of dollars on software that we think will help, and spend too much money, time and effort to implement. And if we can’t understand it all, we have to invest/pay another person to understand and implement it all.

As a subscriber to multiple software platforms to keep our businesses at the forefront of the industry, I can truly share this Business Force One software developed by High Level, makes my job as the CEO a simpler one. Meaning I can see new clients coming in the door from multiple resources, our company follow up, conversions, current client’s information, sales, and special offers in one place."

"As a business owner, it is always important to know the numbers and statistics in your company. To know your best clients, programs, what is working or not working. Many of us spend years and thousands of dollars on software that we think will help, and spend too much money, time and effort to implement. And if we can’t understand it all, we have to invest/pay another person to understand and implement it all.

As a subscriber to multiple software platforms to keep our businesses at the forefront of the industry, I can truly share this software developed by High Level, makes my job as the CEO a simpler one. Meaning I can see new clients coming in the door from multiple resources, our company follow up, conversions, current client’s information, sales, and special offers in one place."

Christina Nelson